Capital Calls & Drawdowns in AIFs: Planning Liquidity Smartly

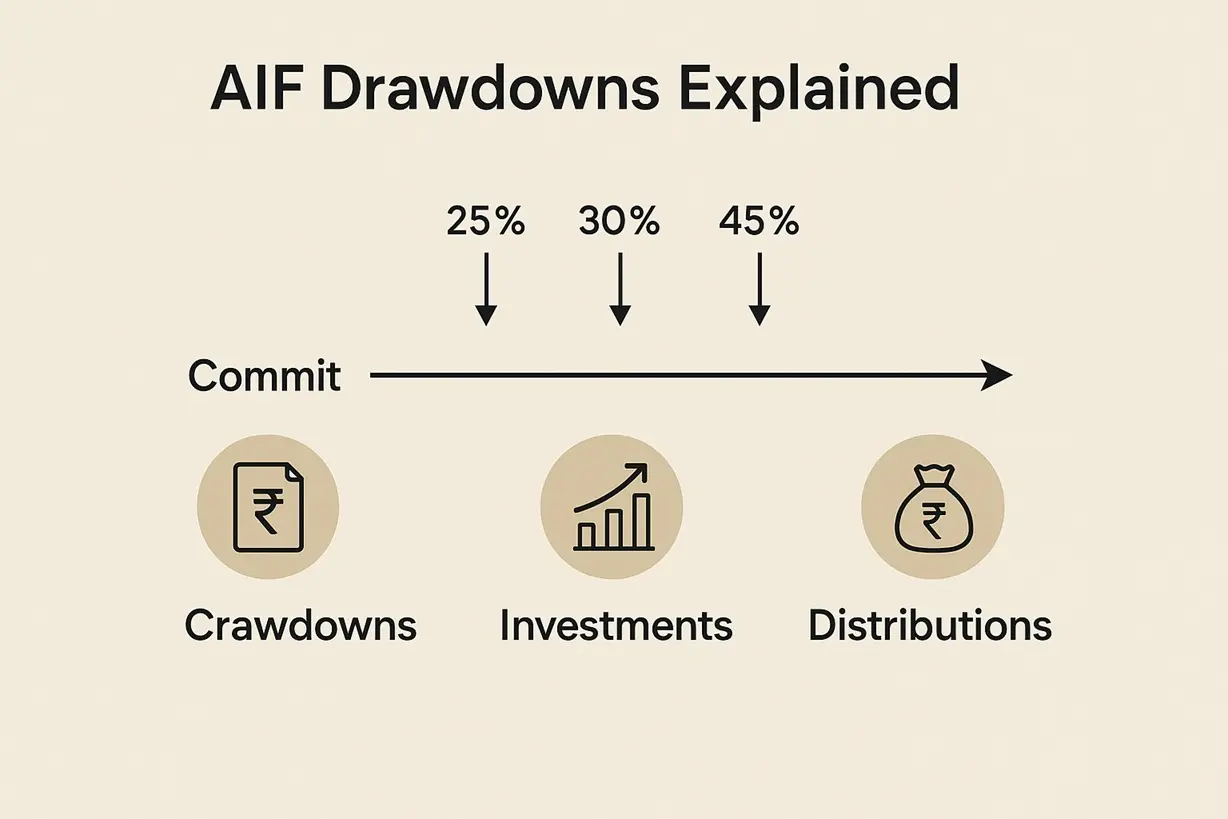

AIF investments are committed capital structures—you pledge ₹1 crore but deploy in tranches called “drawdowns”.

How Drawdowns Work

After commitment, the fund issues capital calls as and when it finds deals—say 25 % immediately, another 30 % after six months, and so on. Uncalled capital remains with you but must be kept liquid to meet deadlines (usually 7–10 days).

Benefits & Responsibilities

• Managers deploy capital only when opportunities arise—enhancing efficiency.

• Investors must ensure timely funding to avoid default penalties.

• Understand whether management fees are charged on committed or drawn capital.

Illustration

A ₹2 crore commitment with five calls of ₹40 lakh each lets you stage your cash flow without locking all capital on Day 1—but liquidity discipline is crucial.

Key Takeaway: Capital calls create flexibility for managers but require financial planning by investors.

Disclaimer: Educational only.