Nov. 8, 2025

Hedge-Style (Category III) AIFs – Managing Volatility with Strategy

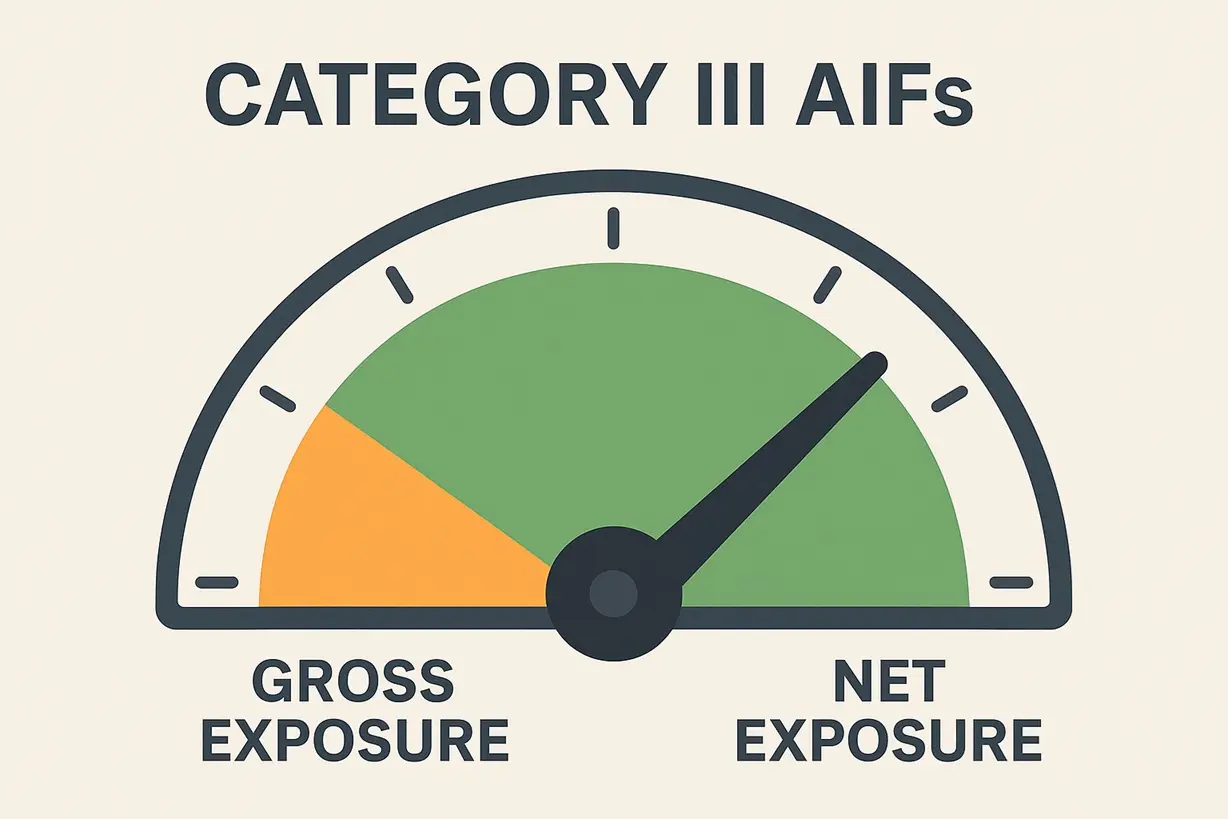

Category III AIFs use hedging and derivatives to deliver absolute returns, similar to global hedge funds.

Core Approach

They take long positions in undervalued stocks and short positions in overvalued ones or indices. Leverage may reach 2x net assets under SEBI caps.

Advantages

- Lower correlation to broader markets.

- Ability to profit in sideways or down markets.

- Dynamic asset allocation based on volatility signals.

Risks

Derivatives amplify both gain and loss. Liquidity mismatch can magnify stress. Manager skill is paramount; check VaR, drawdown, and net-exposure policies.

Key Takeaway: Cat III AIFs are tools for sophisticated investors—understand the engine before pressing accelerator.

Disclaimer: Educational only.