Dec. 12, 2025

Valuation Audits Define Credibility

Overview:

Accurate valuation anchors trust. India’s auditing framework is catching global standards.

Key Points:

- Independent valuation mandatory for all Category I and II Alternative Investment Funds twice a year.

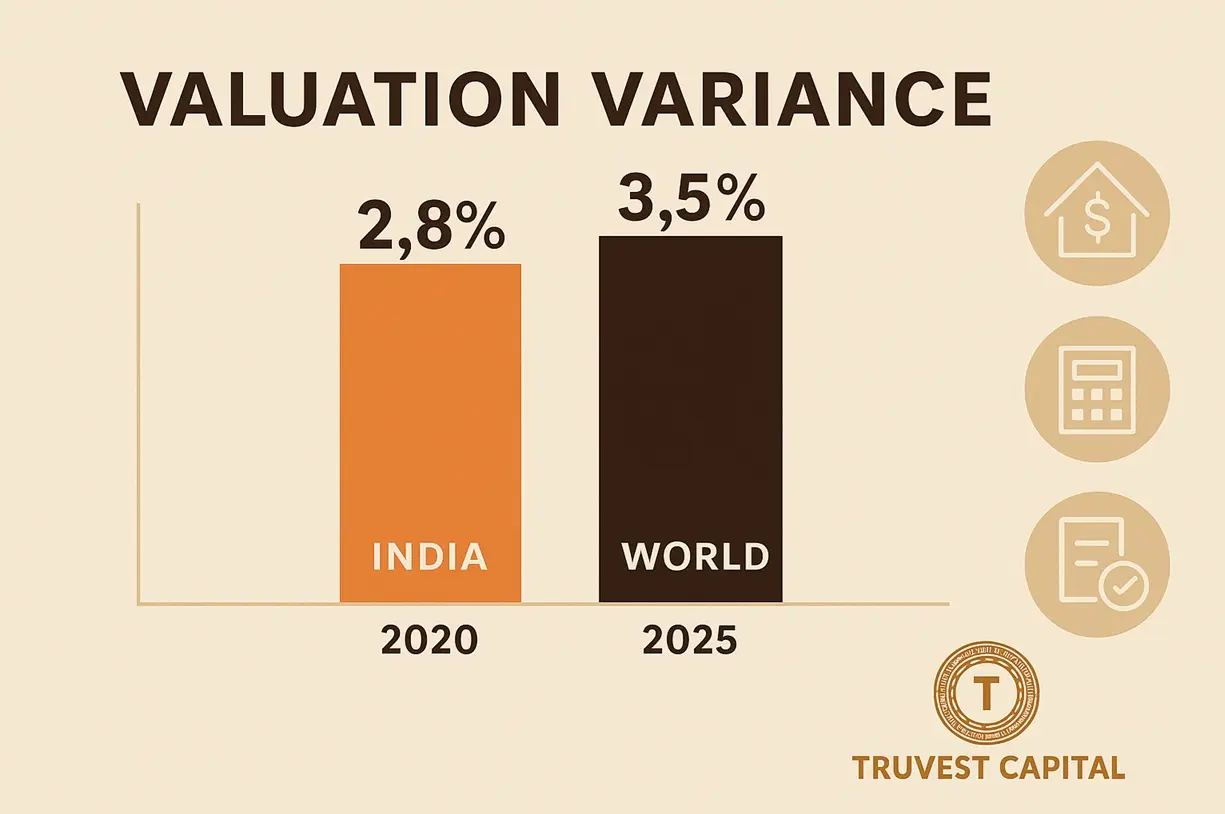

- India’s average valuation variance (estimate vs realised) just 2.8 percent in FY 2025 vs global 3.5 percent.

- Common methods: Discounted Cash Flow (38 percent funds), Comparable-Multiple (42 percent), Independent Appraisal (20 percent).

- Global funds publish quarterly valuation memos; India moving to same cycle by FY 2026.

- Audit turnaround time cut from 60 to 45 days post FY end.

- GIFT City funds are piloting Blockchain-based valuation logs for tamper-proof records.

Truvest Capital Insight:

Transparency in valuation is the currency of global credibility.

Disclaimer: Educational content only. Not investment advice.